‘Rich Dad Poor Dad’ Author Says Buying Bitcoin Is Vital as ‘Crash and Crisis’ Just Starting

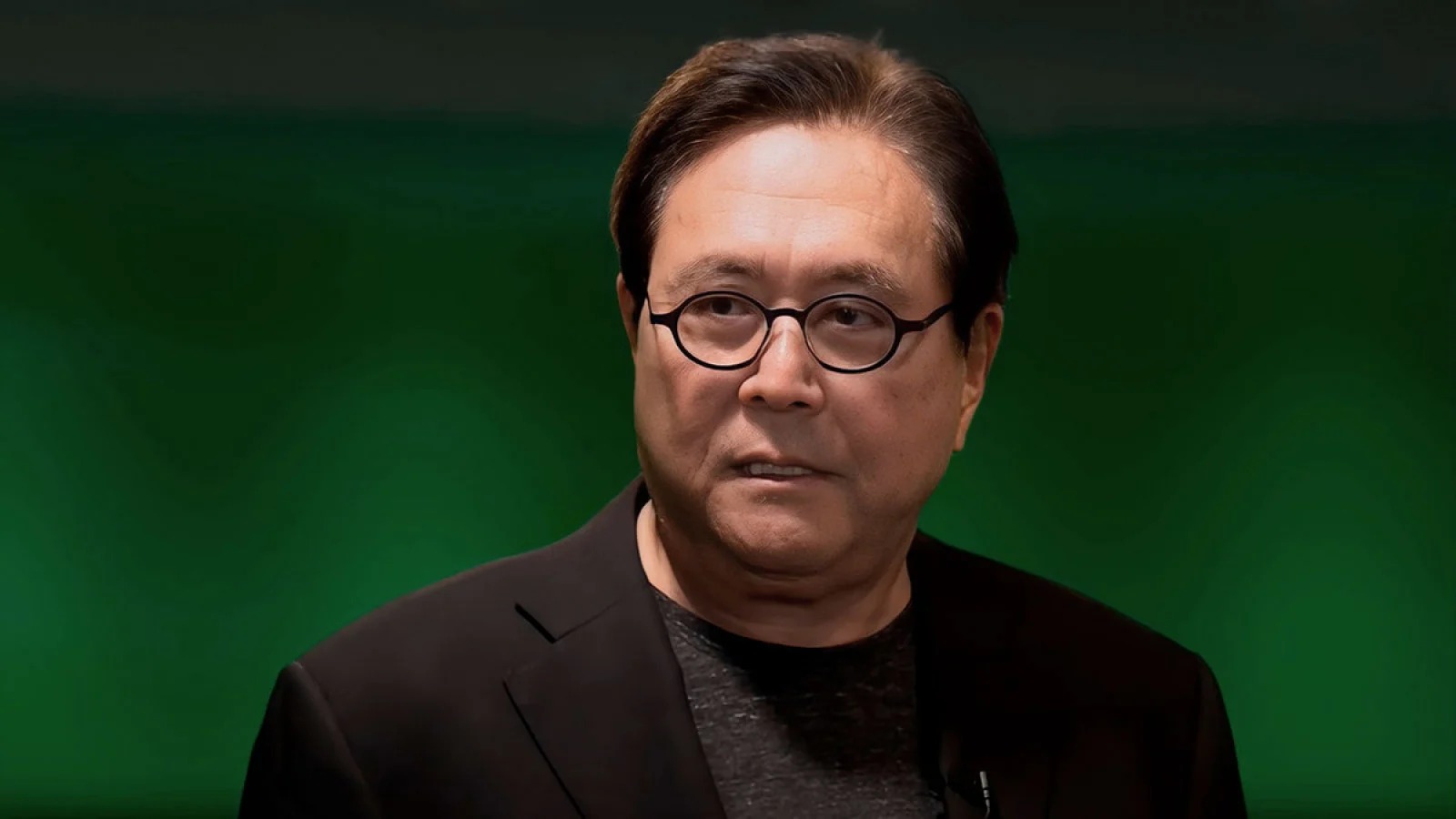

Robert Kiyosaki is an investor, nonfiction writer, and entrepreneur. He is most well-known for his book on financial literacy, ‘Rich Dad Poor Dad’. Now, he has taken to Twitter again to predict an economic and financial crash.

In his tweet, he mentioned Bitcoin, reminding the audience of the importance of the cryptocurrency and a few assets.

SILICON Valley Bank –SILVERGATE Bank –SIGNATURE Bank They were WOKE, and then they went BROKE. Crash and crisis are just beginning. Pensions, IRAs and 401ks all went WOKE going bankrupt. More G,S, BC. Take care.

Robert Kiyosaki (@theRealKiyosaki). March 15, 2023

“Banks went woken and went bankrupt,” “Buy more BTC”

Kiyosaki once again brought the attention of his large twitter audience to the current banking crisis and the collapse of three banks, Silvergate Bank (Silver Valley Bank), Silicon Valley Bank (Signature Bank). These three banks were all crypto-friendly and dealt with crypto exchanges. They also collaborated with stablecoin issuesrs. Some of their cash balances were held by some crypto companies.

Brad Garlinghouse (chief executive at Ripple) recently acknowledged in a statement, that Ripple had some cash balances at Signature Bank. It was only a small amount, and Ripple’s daily operations have not been affected by the bank’s collapse.

The U.S. government also pledged to keep SVB and Signature Bank customers able to access their balances, and to allow withdrawals without spending taxpayers money. Kiyosaki tweeted a sarcastic response to this.

Today’s tweet by he said that the ‘crash’ and ‘crisis’ are only beginning and that U.S. corporate pension program (401k) and pensions (individual retirement accounts), went woke and are now going broke, along with banks.

Kiyosaki ended his tweet by calling for people to purchase Bitcoin, physical gold, and silver to help them hedge against economic risks during this difficult time.

Bitcoin will reach $500,000; gold to climb to $5,000 per Kiyosaki

Kiyosaki stated earlier this year that he expected BTC to reach the astounding level of $500,000 and gold to hit $5,000 an ounce. Silver will surge to $500 by 2025. He believes that the main reason for the surge in BTC is the cumulative effect of the U.S. government printing “billions” in fake dollars.

When the pandemic began in 2020, printing was initiated. Lockdowns were put into place and the U.S. government started providing $1,200 worth of’survival checks’ to average Americans. Bailouts were provided for large banks and businesses.

Kiyosaki now believes that Bitcoin is the “answer to the sick economic system.” According to him, BTC, silver, and gold are the best inflation hedges.

Bitcoin currently trades at $24,553 after briefly reaching the $26,000 mark due to multiple factors including a positive February CPI Report, which led economists to believe that the Federal Reserve will likely begin decreasing rate increases at its March FOMC meeting.