Biden And The Fed Embark On Fresh Multi-Trillion Dollar Bitcoin ‘Marketing Campaign’

The unprecedented stimulation measures resulted in many bigname along with institutional investors turning up into Bit coin , headed by billionaire hedge fund director Paul Tudor Jones who termed Bit coin whilst the’fastest horse’ from the race to overcome inflation.

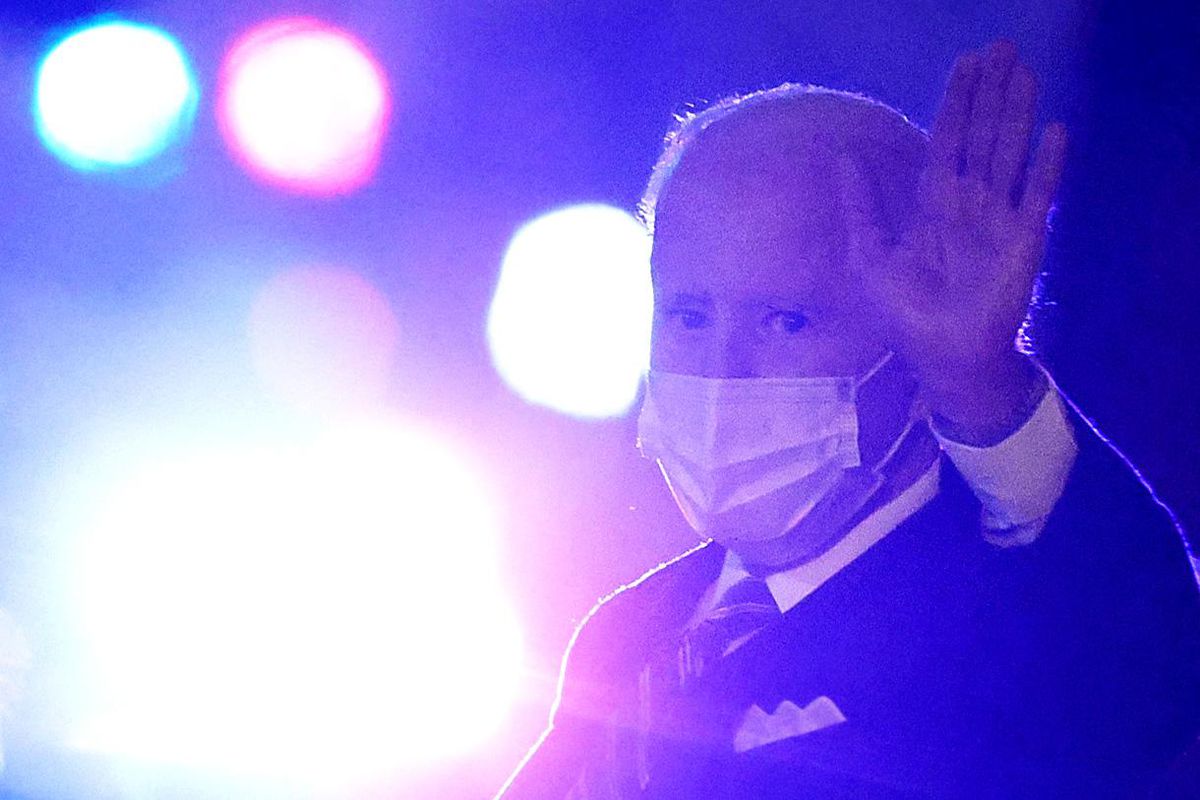

After taper discussion from Fed officials throughout the previous week increased eyebrows one of Bit coin and equity investors, Federal Reserve Chair Jerome Powell has made out hints the central bank gigantic bond-buying effort might possibly be led for a pre mature reduction-just since U.S. presidentelect Joe Biden has issued a $1.9 trillion coronavirus relief suggestion.

‘we all understand we will need to be somewhat careful in communication about strength purchases,’ Powell said, speaking throughout a digital conversation sponsored by Princeton University. ‘Today isn’t the time for you to be speaking about departure. I believe this really is just another lesson of this worldwide financial catastrophe, is careful to not depart too premature ‘

Even the Fed intends to maintain interest rates near zero until inflation has climbed up to its 2 percent target.

Meanwhile, the Joe Biden, expected to be sworn in since U.S. President in a few days, has introduced suggestions known as the’American Immigration Strategy’-for example a supply to enhance the 2nd round of stimulation checks from $600 to $2000, enlarged federal unemployment benefits and $350 billion in local and state aid.

Biden’s stimulation suggestions are anticipated to encourage stocks however might also raise questions concerning the longterm viability of the high government spending.

‘The massive scale of this projected aid measures adds fuel to the flame which taxes and rates of interest might need to move upward,’ Russ Mould, investment manager at Bank AJ Bell said via email.

‘Both have negative connotations for stocks, so projecting a cloud to the capability of stock markets to maintain afloat at precisely the exact same pace they’ve enjoyed for much of 2021. Nevertheless, that the Fed was at pains to worry it wont raise rates anytime in the future, therefore it’s feasible to imply we can carry on to find out burst of energy one of stocks for a little while yet.’

Else where, Bit coin traders see that the brand new spending and currency printing because vindication of these view that Bit coin is actually a hedge against inflation.

‘Since the national administration’s stimulation programs are still unveil trillions of dollars to the economic climate, it introduces significant financial threats, risks of dollar devaluation and inflation,”’ Steven Schnall, ” the leader of New York-based electronic bank Quontic, said in emailed comments.

‘Together with all the Fed adding trillions of dollars into this currency source, it’s inevitable that fiat money will probably be at the mercy of potential devaluation and also there might possibly be significant inflation. We feel bitcoin could function as a potential hedge against those incidents’